What Happened — Explained

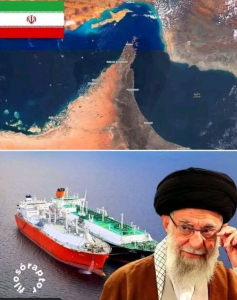

On June 22, 2025, Iranian state-affiliated media reported that Iran’s parliament (the Majlis) voted in support of a motion to close the Strait of Hormuz — a narrow but globally critical maritime chokepoint through which roughly 20% of the world’s traded oil and gas flows each day.

This vote came amid high tensions following U.S. airstrikes on Iranian nuclear facilities — part of a broader regional conflict involving Iran, the U.S., and Israel.

However, it’s important to understand the difference between a parliamentary vote and an actual closure:

🔹 Parliament’s Vote Is Symbolic and Political

-

Iran’s Majlis approved a motion backing the idea of closing the strait as a response to foreign military actions, particularly U.S. strikes.

-

This decision reflects political will and escalatory intent from lawmakers, but it is not legally binding on its own.

🔹 Final Authority Lies Elsewhere

-

The actual power to close or blockade the Strait rests with Iran’s Supreme National Security Council (SNSC) — an executive body that includes top military and political figures — and ultimately the Supreme Leader.

-

Iranian officials and analysts note that the parliament vote alone does not mean the strait will actually be closed — it’s more of a strategic signal than an implemented policy.

So: yes, the parliament backed the concept; no, the strait wasn’t immediately shut.

Why the Strait of Hormuz Matters

The Strait of Hormuz is one of the most important waterways in the world:

-

It lies between Iran and Oman, linking the Persian Gulf to the Gulf of Oman and the Arabian Sea.

-

At its narrowest point, it’s only about 21 miles (34 km) wide, with just two 2-mile shipping lanes separating inbound and outbound traffic — making it a tight corridor where a blockade or disruption would be highly effective.

-

Nearly one-fifth of global oil and gas exports transit this route, including crude from Saudi Arabia, the UAE, Iraq, Kuwait, Qatar, and Iran itself.

Because of this strategic importance:

🔥 A Disruption Would Shake the Global Economy

Even the threat of closure can have dramatic effects:

-

Oil prices surged sharply around the time of the reported vote, reaching multi-month highs amid market fears that energy supplies could tighten.

-

Markets — including crude oil, gasoline, and energy derivatives — are highly sensitive to geopolitical risk in the Gulf, and traders price in the potential for supply shocks quickly.

📈 What a Real Closure Would Mean

If Iran were to truly block the strait — through naval mines, missile harassment, or surface blockades — the consequences could be severe:

-

Major price spikes in oil and gas that ripple through global economies.

-

Strain on countries dependent on Gulf energy, particularly in Asia and Europe.

-

Increased shipping costs and longer transit times as vessels divert around Africa’s Cape of Good Hope.

-

Severe escalation of diplomatic and military hostilities, potentially drawing in the U.S., NATO states, and Gulf Cooperation Council members.

This is why such threats are often used as political leverage but are also taken seriously. However, there’s a balancing act: blockading a route that Iran itself uses for exports would also hurt its economy, making a full closure a high-risk move.

Context: Why Iran Took This Step

Iran’s reported parliamentary decision came amid a period of intense regional conflict:

🔹 U.S. & Israeli Military Actions

-

Iranian nuclear facilities were reportedly targeted by U.S. strikes, actions Tehran and its allies decried as aggression against sovereign territory.

-

Iran’s leadership described these strikes as part of a broader pattern of Western hostility.

🔹 Domestic Political Pressure

-

Hardliners in Iran’s parliament and security circles have been pushing for more assertive responses, including measures that signal resistance to U.S. and Israeli policies.

🔹 Retaliation vs. Escalation

Lawmakers used the closure vote not only as a political statement but as:

-

A show of unity and defiance to domestic audiences.

-

A strategic bargaining chip in negotiations with foreign powers.

-

A signal to allies (e.g., Russia, China) that Iran is prepared to take risky steps unless its security concerns are addressed.

International Reactions

Global governments and markets reacted swiftly:

🇺🇸 United States

-

U.S. officials publicly urged allies (including China) to discourage Iran from shutting the strait, framing such a move as dangerous and destabilizing.

-

Washington also emphasized ensuring freedom of navigation and security in offshore waters.

🌏 China

-

As a major importer of Middle Eastern oil, Beijing has a strong interest in keeping Hormuz open and stable. Diplomatic engagement with Tehran intensified as markets watched.

🛢️ Markets

-

Crude oil prices jumped on risk premiums tied to potential supply disruptions.

-

Shipping firms and insurers reassessed exposure to Gulf transit risks.

So What Happens Next?

1. SNSC Decision

The Supreme National Security Council will decide whether to act on parliament’s recommendation.

-

Closing the strait would be an extraordinary move with enormous global repercussions.

-

Iranian leadership must weigh military retaliation against economic self-harm.

2. Diplomatic Negotiations

World powers (U.S., EU, China) may intensify diplomatic efforts to de-escalate.

-

Negotiating a halt to further hostilities or engaging through intermediaries could reduce the likelihood of closure.

3. Market Monitoring

Energy markets remain volatile as traders incorporate the possibility of disruption into prices and risk models.

4. Regional Security

Neighboring Gulf states (Saudi Arabia, UAE, Qatar) watch closely, as any closure could invite conflict spillover and impact their energy exports.

Bottom Line — What You Need to Know

✅ Parliament backed a motion to close the Strait of Hormuz.

❗ Closure is not yet enacted — final authority lies with Iran’s national security establishment.

⚠️ The potential impact is huge because the strait is vital to global energy flows.

🌍 Global markets and governments are watching closely for escalation or diplomatic solutions.